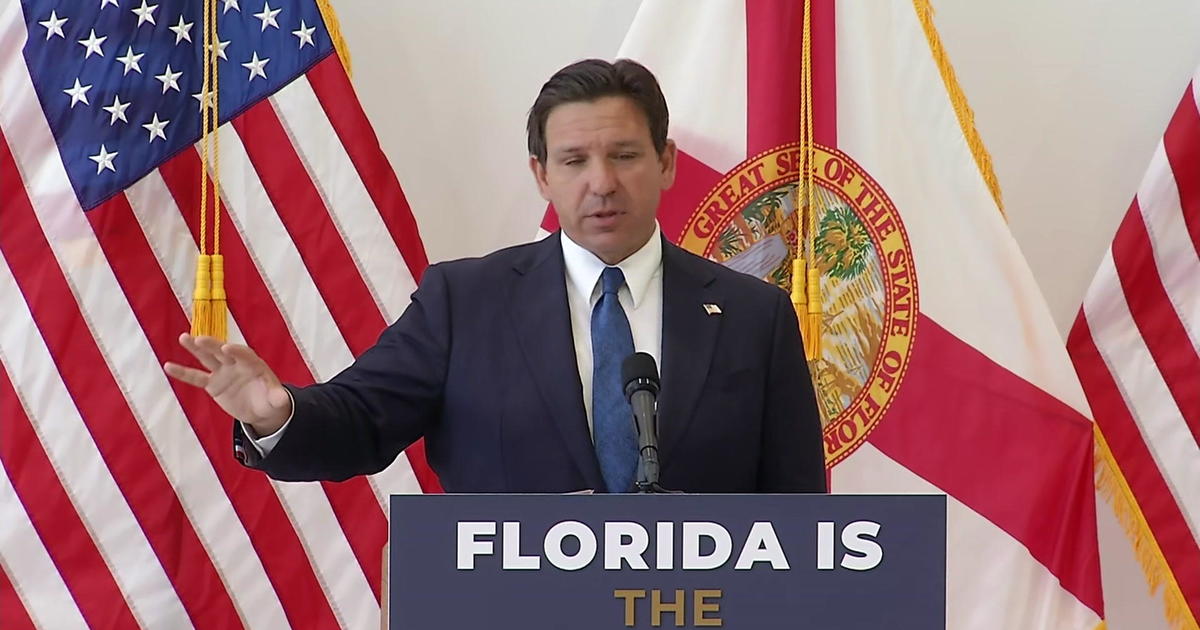

Bill To Shrink Citizens' Insurance Heads To Senate

TALLAHASSEE (CBSMIami) - The Florida House, in an effort to cut the number of people insured by Citizens Property Insurance, passed a bill Friday that would let some customers be sent to largely unregulated 'surplus lines' companies, where critics believe they could see higher rates and higher risk.

The bill approved Friday now moves to the Florida senate, where opponents hope to kill it. They claim that in addition to higher rates, some surplus-lines companies may not have enough money to pay claims in the event of a major storm.

Citizens benefits from a state catastrophe fund, to which every insured person in Florida contributes.

Republican backers of the bill responded that the marketplace will work it out: if people don't like being a customer of a surplus lines insurer, they can always ask to return to Citizens, the state-backed company that is now the state's largest property insurer.

Few disagree that Citizens, which is supposed to be the state's insurer of last resort, has become bloated as Florida's largest property insurer. The company's growth – and years of trying to keep its rates low to be palatable to customers who have no choice about who insurers their coastal property – makes many lawmakers nervous.

The state is the ultimate backer of any Citizens loss, so a massive storm would result in the state's residents being assessed fees to make up any shortfall, and the state's taxpayers could be on the hook as well. Many conservatives say the state shouldn't be in the insurance business – that it's essentially a socialist model.

The bill, backers say, will give some customers a choice of remaining in Citizens or going into an unregulated surplus lines company that's willing to take on their policy.

Opponents say it's a false choice for a couple reasons. One, customers will be notified by letter if a surplus lines company is taking over their policy, and many of them may never see that letter. Opponents said during Friday's debate that non-English speakers, or even people who will think the letter is junk mail, could easily miss the notice. And the bill requires home owners to opt-out of the switch, rather than to opt-in. That is, they'll be switched, unless they affirmatively ask not to be.

That's backwards, said Democrats, including Rep. Richard Steinberg, D-Miami.

"Ladies and gentlemen if it was about choice, wouldn't the letter say 'Do you want to come out of Citizens?'" Steinberg asked.

But the bigger objection was that customers could be unprotected if they are covered by some surplus lines companies. The companies could raise rates, and may not have enough in reserves to guarantee they'll be able to pay claims either in the event of a big storm. And there's no state backing if the company were to fail.

Republican backers of the bill said not only could customers return to Citizens, but that the solution to the insurance problem in Florida has to come from the private marketplace. At some point, they argue, the state has to stop being the main insurer of property. And without de-regulatory changes in the law, private companies simply won't cover Florida property.

And the market will prevent large increases, backers argued.

Two of the backers of the bill acknowledged that the move to unregulated surplus lines companies may not be popular, and may even raise rates.